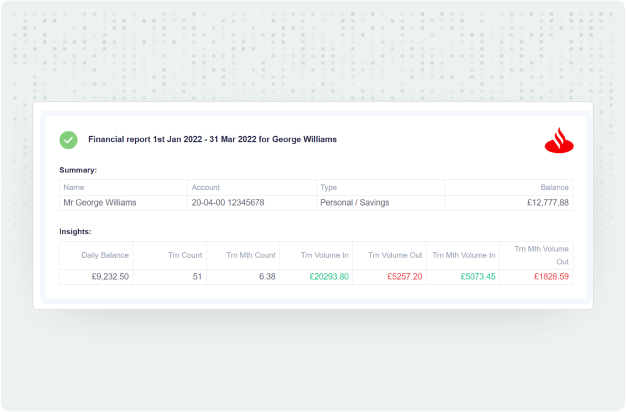

KYC (Know Your Customer), KYB (Know Your Business), and AML (Anti-Money Laundering) screening are critical compliance processes that help businesses verify the identity of customers and companies while preventing financial crimes such as money laundering, fraud, and terrorist financing. These processes are essential for financial institutions, fintech companies, crypto exchanges, and regulated businesses to comply with international regulations and protect against reputational and financial risks.

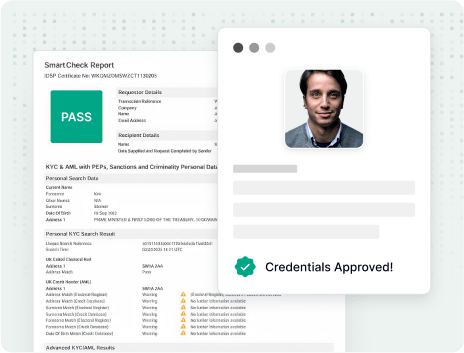

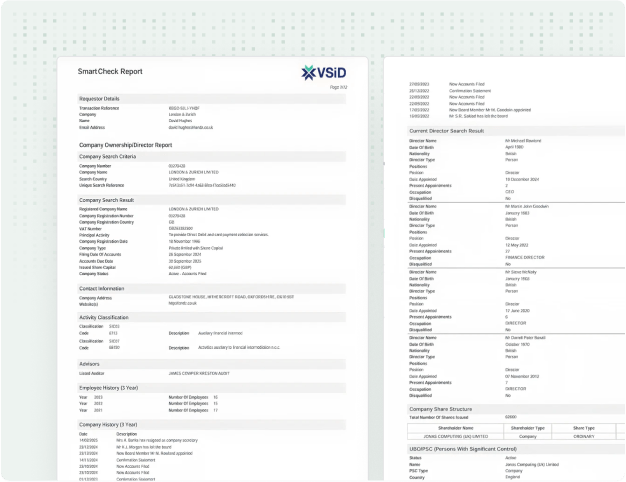

VSID uses advanced identity verification technology, AI-powered algorithms, and global data sources to perform real-time KYC and KYB checks. Our platform screens individuals and businesses against global sanctions lists, politically exposed persons (PEP) databases, adverse media, and watchlists, ensuring full compliance with AML regulations and reducing onboarding risks.

VSID’s screening solutions are ideal for financial services, banking, cryptocurrency exchanges, fintech startups, online marketplaces, legal firms, and any business that requires secure customer onboarding and regulatory compliance. Our platform supports scalable verification processes for both small businesses and global enterprises.

If you would like to know more, see a demo, arrange a free trial or simply get pricing, complete the form, select a date and time from the calendar and we’ll do the rest.

.

You’ll soon receive an email from our sales support team who will be in touch with you very soon.

You’ll soon receive an email with a digital copy of our product sheet and the contact details of our representatives should you have any questions.